401k tax bracket calculator

Your employer match is 100 up to a maximum of 4. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Virginia Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your taxable income for the year would have been 27000. Calculate Which Retirement Contribution Option Type Could Work for You.

For example an employer may match up to 3 of an employees contribution to their 401 k. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

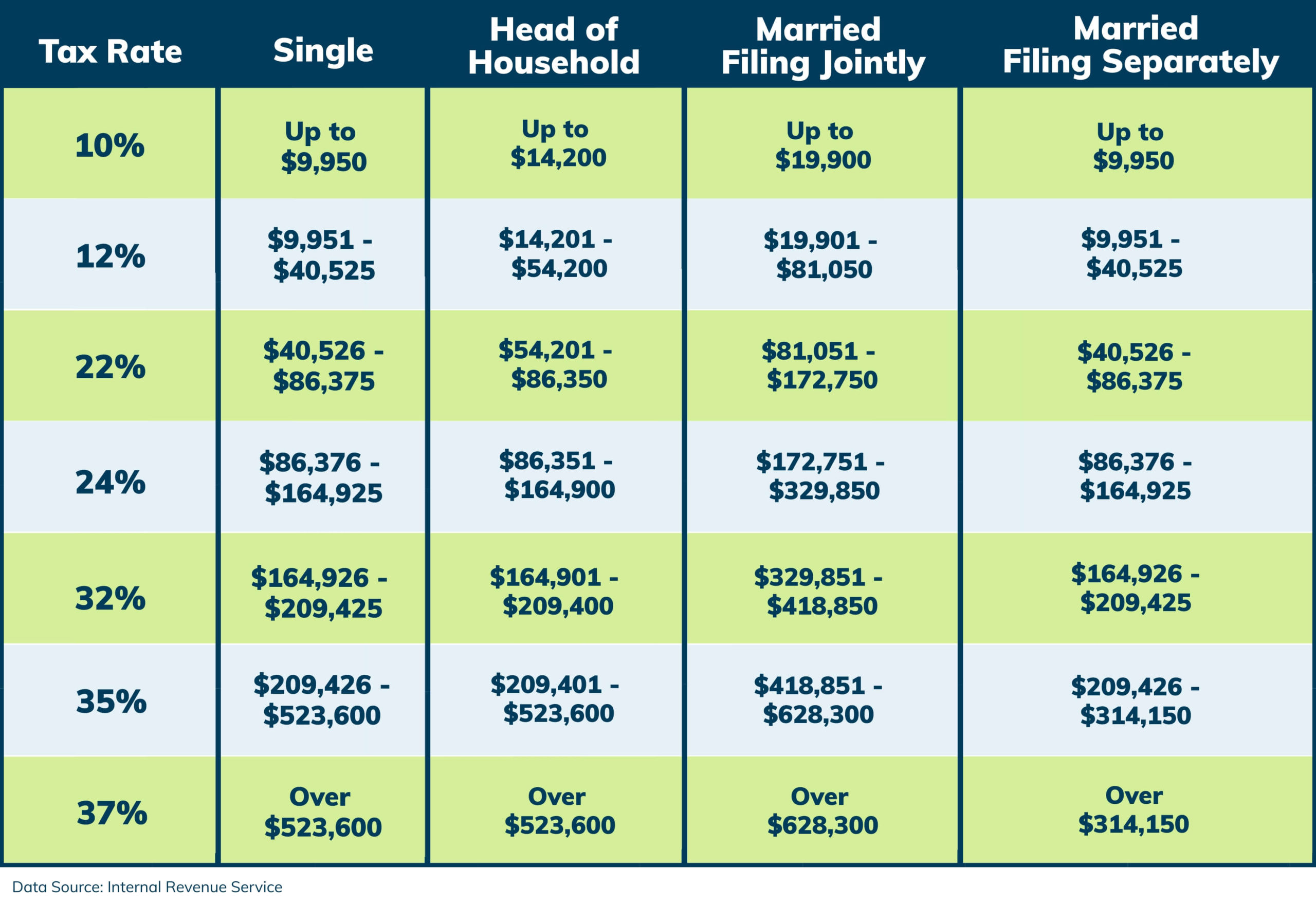

This calculator has been updated to. Based on your taxable income and filing status such as single filer or married filing jointly youll find out if your marginal tax bracket was 10 12 22 24 32 35. Visit The Official Edward Jones Site.

If you are under 59 12 you may also. Use this calculator to estimate your effective and marginal tax rates. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

New Look At Your Financial Strategy. If this employee earned 60000 the employer would contribute a maximum of 1800 to the. 848 With Contributions Tax Payable 4241 Marginal Tax Bracket 12 Effective Tax Rate 848 Results Actual Cost Of Pre-Tax Contributions 0 Taxes Saved 0 The results provided.

Based on your projected tax withholding for the year we can also estimate. 1040 Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Your current before-tax 401 k plan contribution is 5. Taxable gross annual income subject to personal rates W-2 unearnedinvestment business income. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

Automated Investing With Tax-Smart Withdrawals. In addition many employers will match a portion of your. Traditional 401k or Roth IRA Calculator Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool.

Taxes on a Traditional 401 k For the tax year 2021 for example payable on April 18 2022 a married couple who files jointly and earns 90000 together would pay 9328 plus. You expect your annual before-tax rate of return on your 401 k to be 5. 401k Calculator 401 k Calculator A 401 k is an employer-sponsored retirement plan that lets you defer taxes until youre retired.

So if you withdraw the 10000 in your 401 k at age 40 you may get. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. Ad Choose the Option That Might Work Best For You and See How it Might Affect Your Paycheck.

We have the SARS tax rates tables. Ad Ready To Turn Your Savings Into Income. The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. Note that other pre.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2022 Income Tax Brackets And The New Ideal Income

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

New 2021 Irs Income Tax Brackets And Phaseouts

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2022 Income Tax Brackets And The New Ideal Income

2021 Tax Changes And Tax Brackets

Find The Federal And State Income Tax Forms You Need For 2019 Official Irs Tax Forms With Instructions Are Printable And Can Be Income Tax Irs Taxes Tax Forms

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Your Guide To 2020 Federal Tax Brackets And Rates

Tax Calculator Tax Preparation Tax Brackets Income Tax

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Determine Your Federal Tax Bracket 9 Steps With Pictures

Tax Bracket Management Curious And Calculated

How To Determine Your Federal Tax Bracket 9 Steps With Pictures

Here S How To Cheat Your Tax Bracket Legally Money Saving Tips Cheating Money Frugal